Importers Sentenced to Prison for Fraudulently Evading $42M in Customs Duties

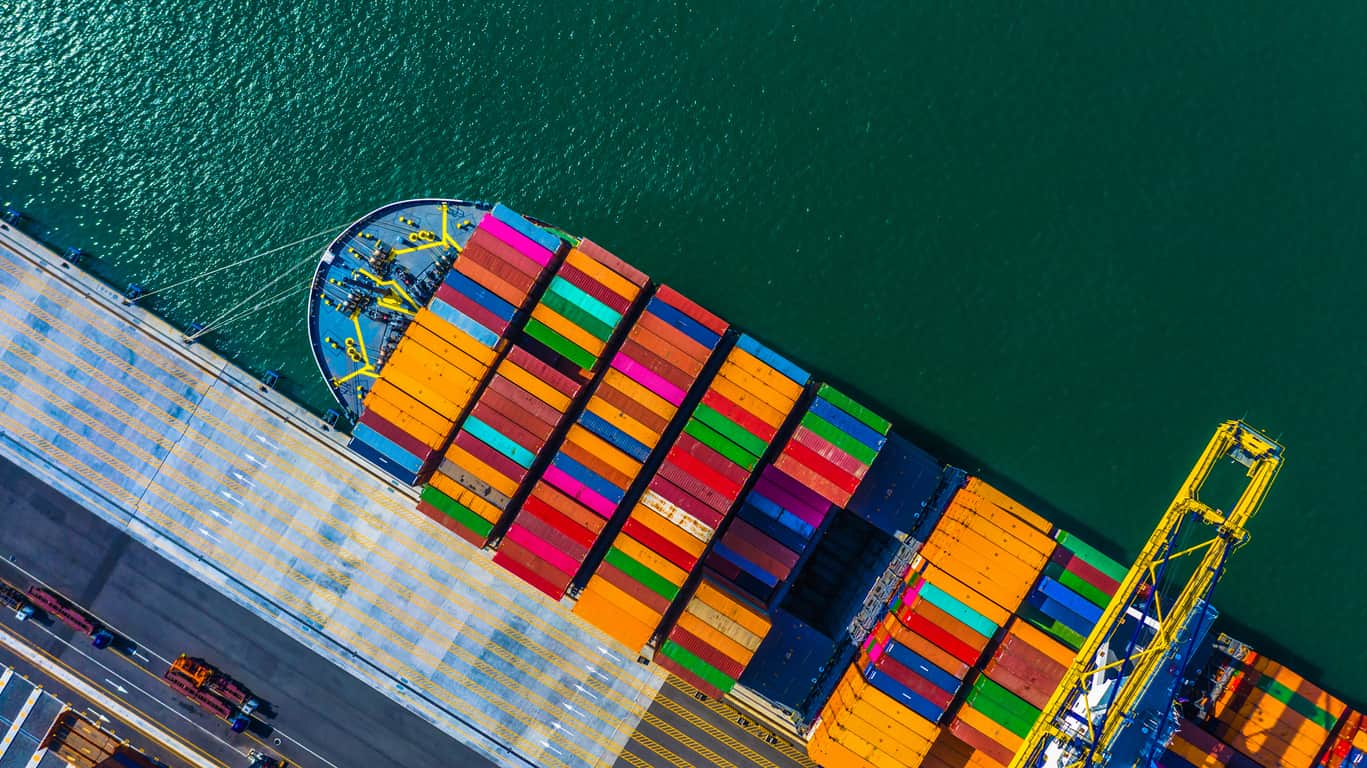

The conspirators allegedly transshipped Chinese-manufactured merchandise through Malaysia, then falsely declared its country of origin as Malaysia instead of China when importing it into the United States A federal court has sentenced a Florida couple to five years in prison for fraudulently evading $42.4 million in customs duties on imports of Chinese plywood. According to prosecutors, the pair caused the