Customs-Fraud Whistleblower receives $115K Award.

Drug distributor Danco Laboratories has agreed to pay $765,000 to resolve a federal whistleblower lawsuit alleging it violated the False Claims Act by failing to pay marking duties on products it imported from China without country-of-origin labels.

Imports are required to be labeled with their “country of origin,” meaning the country where the product was manufactured or produced or where work was performed resulting in its “substantial transformation” into the finished article.

Importers that violate this labelling requirement are subject to so-called “marking duties” of 10%, which are calculated ad valorem or based on the value of the goods.

According to the whistleblower’s allegations, Danco imported cartons of drug blister packs manufactured in China that lacked country-of-origin labels. It should have paid marking duties on those imports but nevertheless knowingly failed to do so, the U.S. Department of Justice alleged. Danco also filed Form 7501 entry summaries with U.S. Customs and Border Protection (CBP) allegedly omitting required country-of-origin disclosures.

The whistleblower received $115,000 from the proceeds of the settlement as a reward.

The False Claims Act and Customs Fraud

Importers are required to file customs entry documents including Form 7501 entry summaries with CBP declaring the country of origin, value of the merchandise, tariff classification, and the amount of duties owed. They must also attest to the accuracy of those statements.

Knowingly failing to declare and pay customs duties is a serious offense and may violate the False Claims Act, which imposes significant liability—including three times (or “treble”) damages—on parties who fraudulently overcharge or underpay the U.S. government or its agencies.

The False Claims Act’s qui tam or whistleblower provisions permit private parties, known as a relators, to file lawsuits on the government’s behalf and receive a portion of any recovery. Generally, whistleblowers are awarded 15-30% of the case’s proceeds.

Combating customs fraud is a top priority of the Justice Department. Import tariffs and customs duties are the government’s largest source of revenues after income taxes.

Import-duty frauds generally involve underdeclaring the dutiable value, declaring an incorrect U.S. Harmonized Tariff Schedule (HTS) classification or country of origin, or—as alleged against Danco—failing to pay marking duties despite lacking appropriate country-of-origin labelling.

Country-of-origin frauds frequently involve “transshipment”—the improper routing of goods through third countries which are then fraudulently declared as the country of origin when those goods are entered through customs in the United States.

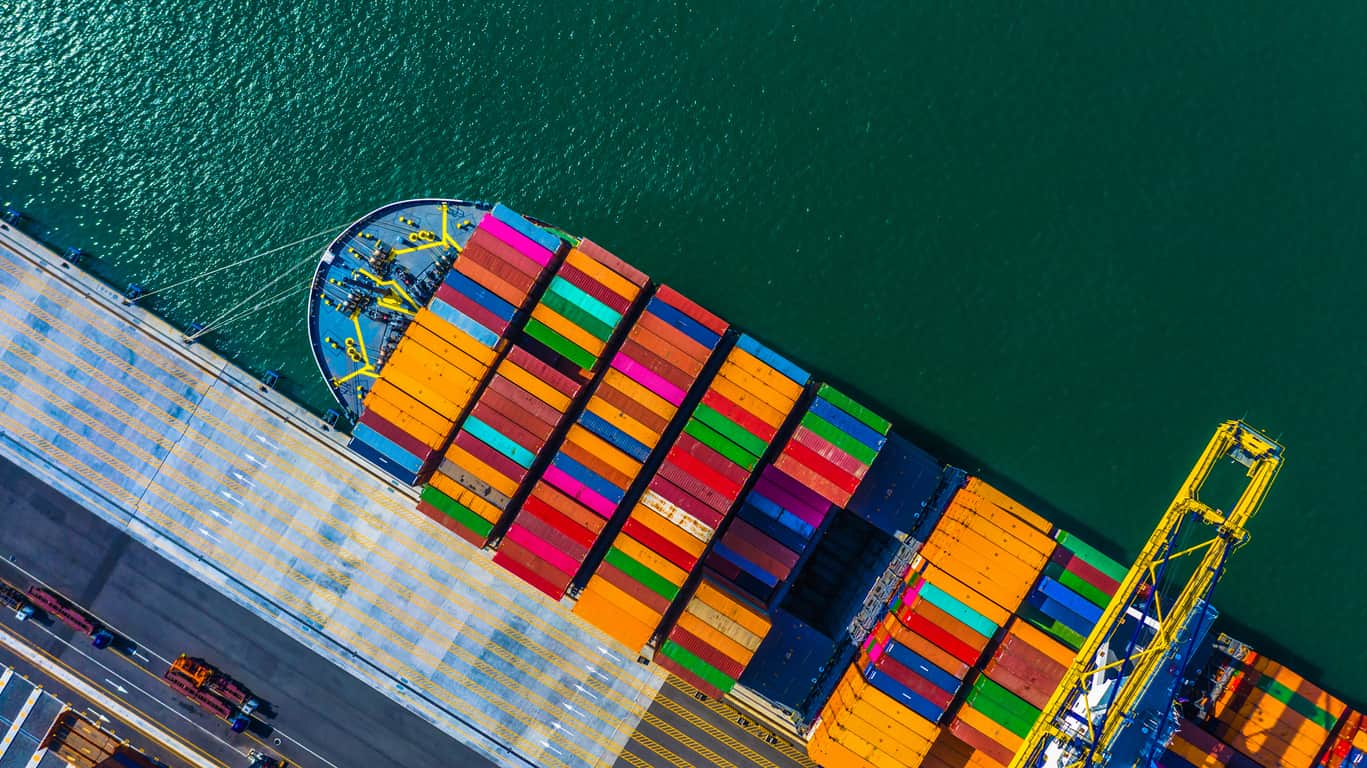

Customs fraud is on the rise, particularly with respect to imports from China. The U.S. has imposed tariffs of up to 25% on a wide range of Chinese products under Section 301. Schemes to circumvent those tariffs have proliferated.

Customs-fraud whistleblowers generally work in sourcing, procurement, logistics, or finance. They can live outside the United States and need not be American citizens. Employees, competitors, and business-counterparties of importers as well as other parties can potentially serve as False Claims Act relators and receive whistleblower awards.

Customs fraud burdens American taxpayers and injures law-abiding importers who are entitled to a level playing field but, instead, face unfair competition from fraudsters.

Fraud is their game.

Integrity is yours.

Speak with a Customs-fraud Whistleblower Attorney

If you know of parties fraudulently evading customs duties or otherwise defrauding the federal government or its agencies, it is vital to speak with an experienced customs fraud whistleblower lawyer regarding your rights under the False Claims Act. Call customs-fraud whistleblower attorney Mark A. Strauss, who has more than 20 years of experience handling complex litigation including customs-fraud whistleblower cases, for a free and confidential consultation. All communications are protected by attorney-client privilege.

Remember that you must file a False Claims Act lawsuit to receive a qui tam whistleblower award. Simply alerting CBP or another government agency to wrongdoing by calling a tip line or filing a complaint with an an agency reporting system is not sufficient.